‘India is pioneering a new model of economic development that could avoid the carbon-intensive approaches that many countries have pursued in the past – and provide a blueprint for other developing economies,’ said Dr. Fatih Barol, Executive Director, International Energy Agency earlier in 2022.

India is already the third-largest electricity consumer globally and also the third-largest renewable energy producer.

The country, home to one-sixth of the global population, has traditionally been dependent on fossil fuels for its energy needs. However, various geopolitical developments, detrimental impacts on the environment due to the rising use of fossil fuels, and the increasing burden on the exchequer have led India to explore the path of energy transition. India is also committed to the Paris Climate Accord, where it pledged to reduce emissions by 33-35 percent of its GDP by 2030 vis-à-vis the 2005 level.

Access to affordable and reliable energy has been a vital focus of the country’s power sector. In the last decade, India has managed to add 50 million people to the electricity grid each year. Yet, the recent coal crisis and its impact on the power sector have led to realigning the various elements within the sector. This is imperative as India aims to be a leader in renewable power and aims to be carbon neutral by 2070. Despite the covid-19 impact, the Minister for Power, New and Renewable Energy had said that power demand in India would grow beyond the peak demand witnessed at 210 GW. In fact, the minister was confident on India’s energy transition plans as he opined that though coal would continue to be a major part of power generation, the country would easily achieve the target of 50 percent of energy share from non-fossil fuels before the deadline of 2030.

India’s target of generating 500 GW of renewables by 2030 is over 300 percent from the current installed levels, indicating a gargantuan increase. The target will play a crucial role in offsetting carbon emissions by 1 billion tonnes.

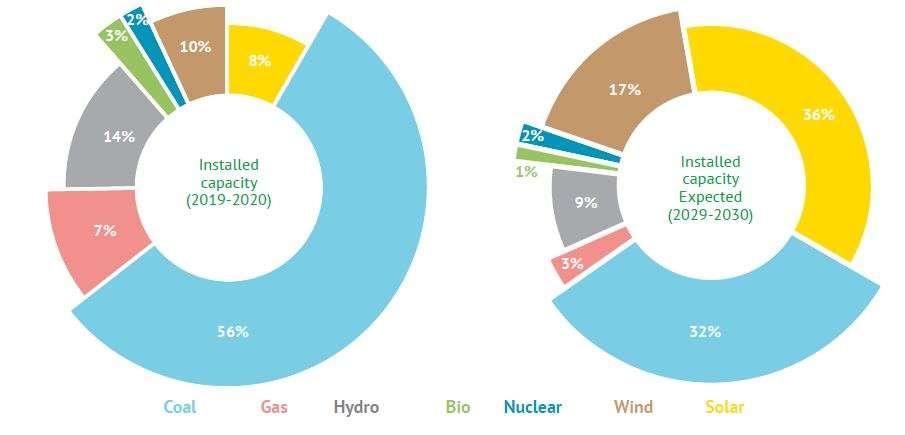

In the last ten years, India has scaled up solar power installations from just 35 MW in 2011 to 35,000 in 2021, a 1,000 per cent jump. Currently, the total installed power capacity in India is about 402 GW, from which the fossil fuel capacity is 236 GW.

India is among the top-three electricity consumer and also the top-three renewable energy producer. The scale of transformation is promising and is in line with the economic growth in the last two decades.

As per a report by the World Economic Forum, “Mission 2070: A Green New Deal for a Net-Zero India”, the country’s transition to a net-zero economy can create over 50 million jobs and contribute over USD 1 trillion in economic impact by 2030 and around USD 15 trillion by 2070. All these are promising signs for India. India could emerge to be a global leader in the clean energy transition scenario.

*Economic Times

The Energy Mix

The Central Electricity Authority (CEA) estimates that in the next decade, the share of renewable energy will increase to 44 per cent from the current levels of 18 per cent. While the total installed capacity is expected to be about 832 GW, renewable power (including hydro) is expected to be almost double at 523 GW, as compared to 291 GW of thermal power.

Energy Storage

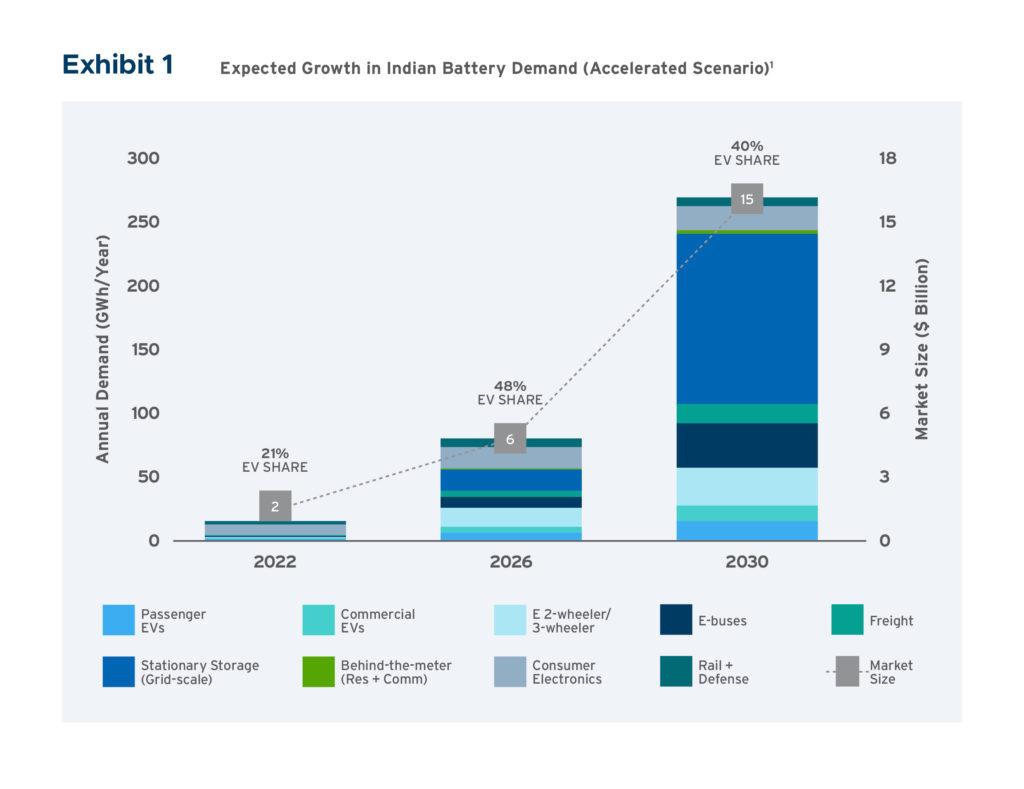

One of the most critical elements to achieving energy transition is energy storage. India, which currently has just 20 MW of installed battery storage capacity, is expected to add 1.3 GW of storage capacity soon. Storage solutions can facilitate meeting electricity demand despite low generation and provide balancing to the grid. Furthermore, storage solutions for local demand management at the transformer level can give an alternative to traditional capital-intensive network enhancements.

As per the NITI Aayog, India’s battery storage market of 1000 GWh by 2030 will lead to a cumulative market size of USD 250 billion. The CEA estimates that the cost of battery energy storage in India is expected to fall from INR 7 crore per MW in 2021–22 to INR 4.3 crore per MW in 2029–30, pushing for greater energy storage adoption in the years to come.

In this direction, the Solar Energy Corporation of India (SECI), and PSU NTPC Ltd announced tenders for 4 GWh of standalone battery energy storage capacity. The SECI has already issued tenders for setting up 500/1000-MWh Standalone Battery Energy Systems. A BESS system is made up of batteries that can be charged by solar power during the day, which is then available at night.

In this direction, the International Energy Agency is expecting India to have about 140 GW of battery storage by 2040, the largest in any country. However, as per the Observer Research Foundation, India will require 63GW BESS for achieving the 500 GW of solar energy capacity.

Going by the industry experts, over 1 GW of decentralized hybrid storage inverters can be installed until 2023, if the right policies are made. The government had recently sought recommendations for bringing in a comprehensive policy framework for the energy storage sector.

The India Energy Storage Alliance estimates that the Lead Acid Battery Market is around Rs 27,000 crore (USD 3.4 billion). In the current market scenario, inverter and UPS applications will be taking the lion’s share of 60 percent of the stationary and motive battery mark.

However, the industry wants the policy makers to provide financial support benefiting domestic manufacturing facilities and reduce GST on batteries, which is currently at 28 per cent. Additionally, transmission waivers and interest rate subsidies will facilitate in reducing the per-unit cost of energy to consumers. RE Certificates can also be awarded for every unit of energy dispatched from the storage system in the next 3-5 years.

A study by KPMG and Wartsila estimates that India will need 38 GW of four-hour battery storage and 9GW of thermal balancing power projects by 2030 for reliable integration of renewables. The National Renewable Energy Laboratory foresees that India’s storage technologies’ capacity can reach between 180 GW and 800 GW by 2050.

Recently, Danish-owned Danfoss India opened India’s first privately owned and operated grid-scale battery-based Energy Storage system. The engagement of the private sector to foray into storage systems will be vital in scaling up energy storage deployments in India.

However, challenges including capital required for funding deployment of battery storage at scale and lack of familiarity with storage solutions and their performance can be the deterrents for wide-scale adoption of storage solutions.

*Niti Aayog Report

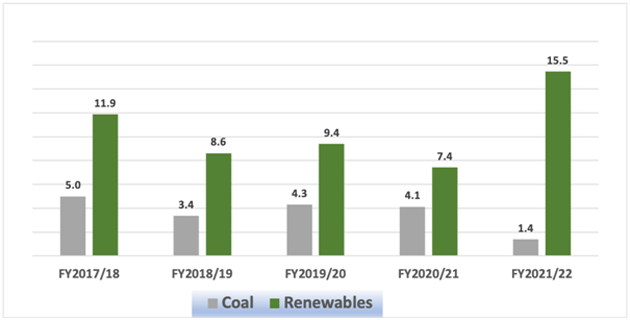

Investments

It is estimated that the 1000 GWh capacity deployment will entail a manufacturing investment of around USD 16.5 billion in the next five years, creating jobs both in manufacturing and construction.

India’s largest company by market capitalization, Reliance Industries in 2021 had announced a USD 50-million investment in US-based energy storage start-up Ambri. Tata Power, one of the largest power sector companies in India, had announced the setting up of India’s first large-scale 50 MWh battery storage system co-located with a solar PV plant at Leh. One of the largest manufacturers of industrial and automotive batteries, Amara Raja Batteries, had invested USD 5 million last year to pick up equity in Log 9 Materials, a Bengaluru-headquartered advanced battery-tech, and deep-tech start-up.

Another renewable energy major Greenko Group has unveiled plans on building the ‘world’s largest renewable energy storage facility in the Indian state of Andhra Pradesh. With investments of USD 3 billion, the 5.23 GW project is located in Kurnool.

Policy Level Initiatives

The Department of Heavy Industries, Government of India, issued a notification in 2021 for enhancing domestic manufacturing of advanced chemical cell battery storage. This Production Linked Incentive (PLI) Scheme ‘National Programme on Advanced Chemical Cell Battery Storage’ is a five-year program of USD 247 billion to incentivize potential investors for setting up giga-factories. It aims to achieve 50 GWh of advanced chemistry cell and 5G Wh of niche advanced chemistry manufacturing capacity. PSU Bharat Heavy Electricals Limited had already invited bids for selecting partners to set up a gigawatt-scale advanced chemistry cell battery storage facility as it aims to bid out at least 5 GWh capacity. As per MERCOM India, there are around 65 renewable projects plus storage projects announced from which just six have a total storage capacity of 136 MWh.

Global Energy Storage

Globally, the manufacturing capacity of battery storage has grown sevenfold to 1,500 GWh in the last ten years, of which China holds 78 percent. Europe is also emerging as a key investment destination for battery manufacturing.

Conclusion

India’s climate adaptation and mitigation ambitions will be transformational both for the 1.3 billion population but also for the greater good of the planet. With the country already lifting millions of people out of poverty, it is remarkable that the carbon emissions per person are still the lowest in the world. The extreme climate events, as witnessed in the heat wave in 2022 and the higher use of coal to meet the surging energy demands of the population can be an Achilles heel to India’s energy transition goals. Nonetheless, the intent and resolution on the part of the government as well as the industry are not to be missed.