India, one of the largest consumers of gold globally, launches its first-ever international bullion exchange. This endeavour is to attract investments including those from foreign banks, besides bringing transparency to the pricing of the precious asset class. Located in Gujarat’s International Finance Tec-City, or GIFT City, the India International Bullion Exchange (IIBX) can be an enabler for qualified bullion dealers and jewellers to trade.

As per the World Gold Council, India was the second biggest consumer of gold with 797.3 tonnes in 2021, a 78.6 per cent jump from 446.4 tonnes in the previous year. The India International Bullion Holding IFSC (International Financial Services Centre) Limited is a joint collaboration involving the Central Depository Services Limited, National Securities Depository Limited, Multi Commodity Exchange of India Limited, India INX International Exchange Limited, and National Stock Exchange of India Limited.

It is expected to attract dealers, refineries, and foreign banks, besides allowing more jewelers to import the precious metal. At the time of setting up the IIBX, 64 jeweler` had already come onboard with more applications in the pipeline. These included Augmont Enterprises, Banglore Refinery, Kalyan Jewellers, MMTC-PAMP, Malabar Gold, PN Gadgil Jewellers, Raksha Bullion and Titan among others. The trades will be exempted from local duties unless goods are moved outside the city. It is expected that the bullion flows will enable India to become a regional hub akin to exchanges like Borsa Istanbul and Shanghai Gold Exchange.

Investment for All Seasons

In India, gold is considered not just a valuable possession but also an auspicious article during festivals and weddings. The exchange aims at offering silver trading in the future too. Without doubt, it may also be able to allure global Indians.

As per the Global Gold Council, Indian households have an estimated 25,000 tonnes of gold, which is passed on from one generation to the next. Since time immemorial, gold has been of immense value to Indian families as it is used in almost all significant occasions of life.

Jewellery demand skyrocketed by 96 per cent at Rs 261,140 crores (USD 33 billion) in 2021, from Rs 133,260 crores (USD 16.2 billion) in 2020. In fact, the total investment demand was up by 43 per cent at 186.5 tonnes vis-à-vis 130.4 tonnes in 2020. In the value terms, demand was up by 45 per cent at Rs 79,720 crores (USD 10 billion) against Rs 55,020 crores (USD 6.9 billion) in 2020. The World Gold Council anticipates that the consumption will remain at a steady 800 tons in the current year especially with rural India driving economic recovery. Furthermore, the thrust by Indian government on digital gold savings, is an indicator of buying behaviour in investment gold.

However, the domestic market is plagued occasionally by challenges like lack of quality, high market fragmentation and weak price transparency. Hence, a bullion exchange was long due as a vital solution to bring lustre to gold trade in the country.

Why Bullion Exchange for Gold

Physical gold and silver of high purity, often kept in the form of bars or coins, is called bullion. Bullion is held as reserves by central bank considering they are a legal tender. It is expected that the bourse will enable qualified jewellers to import gold, a major change from current rules where only select banks and agencies approved by central bank can do. Ultimately, this can result in ‘efficient’ price discovery with the assurance of responsible sourcing and quality. As per the International Financial Services Centre Authority, it can foster financialisation of gold in India and widen the importer base.

It is expected the new exchange can offer products and technology far more competitively than other regional and global exchanges such as Hong Kong, Singapore, Dubai, London, and New York.

Gold being a highly regulated commodity, the central bank has nominated some banks and agencies to import and sell to jewellers and dealers. As per the government, the IIBX’s technology-driven solutions can facilitate transition of the market towards an organised space by giving jewellers access to importing gold directly through the exchange. India had imported about 1,069 tonnes of gold last year. Currently, India has the National Commodity and Derivates Exchanges offering gold futures contracts in India. However, there was no physical exchange for buying gold. With India having an estimated 24,000 tons unused gold, the government introduced the Gold Monetisation Scheme in the Union Budget, 2015. The gold accumulated was to be used productively and profitably, by banks, through a gold loan at lower interest rate to meet inventory financing needs of the borrower.

Global Gold Landscape

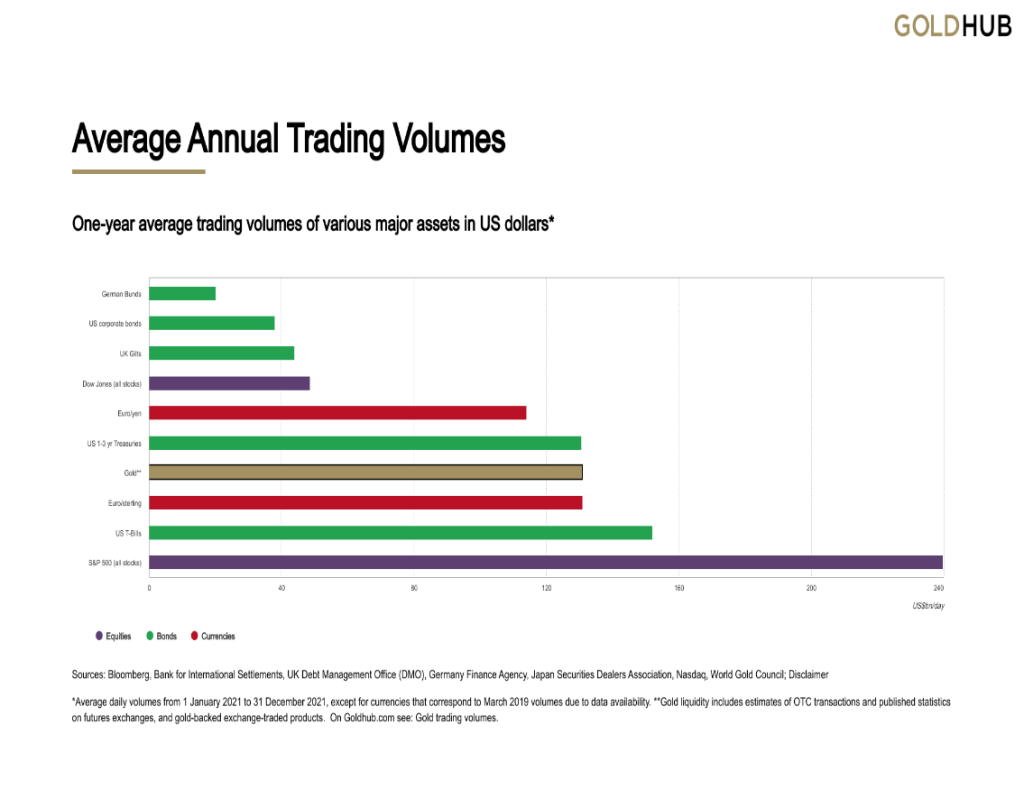

Gold is a liquid asset, which is comparable to most global stock markets besides the currency spreads. The liquidity of gold is an important factor especially during times of stress, making it one of the most sought-after commodities. As per the Global Gold Council, the average trading volumes were $132 billion in 2021. The below graph demonstrates Gold being amongst the largest traded commodities globally.

* Sources: Bloomberg, Bank for International Settlements, UK Debt Management Office (DMO), Germany Finance Agency, Japan Securities Dealers Association, Nasdaq, World Gold Council (2021)

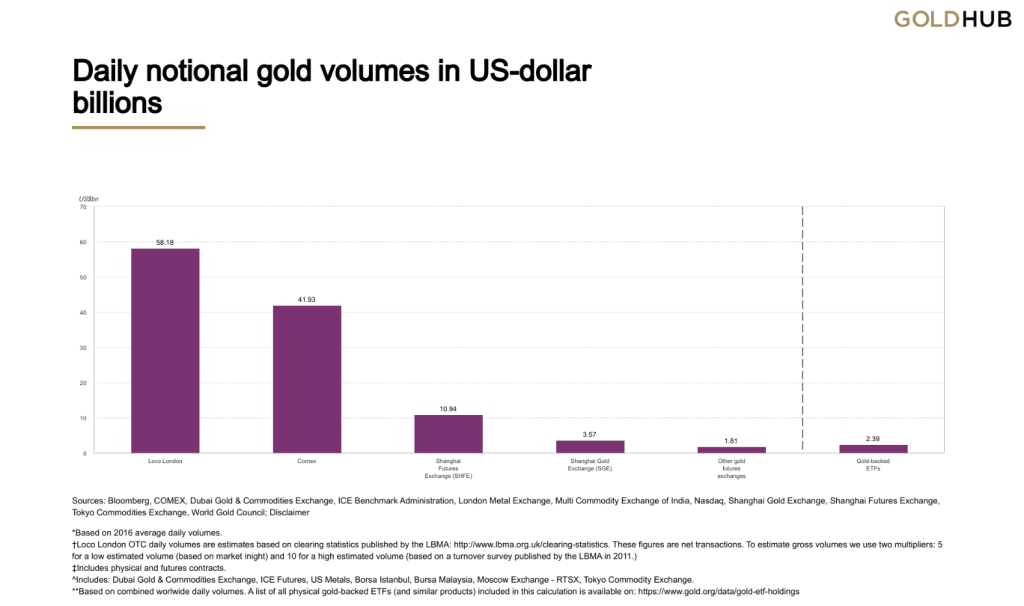

The landscape for wholesale gold trading is quite complex and constantly evolving. The three most important gold trading centres are the London OTC market, the US futures market, and the Shanghai Gold Exchange (SGE). These markets comprise more than 90 per cent of global trading volumes and are complemented by smaller secondary market centres around the world (both OTC and exchange-traded).

Shanghai Gold Exchange is the world’s top gold consumer, running a bourse, where domestic production and imported gold can be purchased and sold. It is also the largest physical spot exchange globally. Established in 2002 with supervision of the People’s Bank of China, the exchange introduced Shanghai Gold Price benchmark in 2016 for cementing China’s role as a price-setter and broadening the international participation in the Chinese market. The Chinese government implemented several other policies, including no VAT (value-added tax) on gold purchases, unless a profit is made.

The London OTC market, which has been the centre of gold trade since time immemorial, today comprises about 70 per cent of global notional trading volume. The market also has an advantageous time zone, bridging Asian and US trading hours, besides benefitting from being a leading global financial services hub. On the other hand, the US futures market (COMEX), operated by CME Group, has become important for price discovery. The exchange has successfully tapped into the Asian market growth over the years. Some of the secondary market centres include Dubai, Japan, Singapore, and Hong Kong, offering diverse range of spot trading facilities.

History

Back in 2018, the Indian government think tank, Niti Aayog had suggested setting up a spot exchange for bullion to provide an efficient and trusted ecosystem for trading gold. As per the body, this would protect interest of market participants as well as facilitate India to emerge as a price setter for gold. In the subsequent year’s budget, the IIBX was announced by the finance minister.

“The Government will formulate a comprehensive Gold Policy to develop gold as an asset class. The Government will also establish a system of consumer friendly and trade efficient system of regulated gold exchange sin the country. Gold Monetization Scheme will be revamped to enable people to open a hassle-free Gold Deposit Account” – the Union Budget (2018-19) Speech of the Finance Minister, February 1, 2018.

As per the report, the Indian refining sector has under-utilisation of capacities. With approximately 32 refineries, the combined capacity is about 1300 to 1400 tons. Utilisation across the industry averages just 20 percent to 30 percent with just five Indian refineries accounting for refining of 90 percent of gold imports. Only 11 refineries were certified by the BIS, with just one LBMA gold delivery refinery. The report recommended exploring the possibilities of re-exporting the refined gold. It further said that there was a need to develop “Indian Good Delivery Standard”, which would encourage refining for exports and be acceptable by banks and exchange traded funds.

The report also suggested that the futures exchanges operating are used just for hedging risks against gold while a spot exchange focuses on price discovery. There was thus a need to set up Bullion Exchanges providing an efficient and trusted ecosystem for trading gold and ensuring the success of financialisation of gold.

The India International Bullion IFSC Limited, a holding company, was created after an MoU between India INX International Exchange, National Stock Exchange and the two depositories including NSDL and CDSL. In August 2021, a pilot was launched but the operational commencement was delayed.

IIBX Initial Trading

In the beginning, one kilo gold of 995 purity as well as gold mini in 100 gram and of 999 purity will be traded. The quality will be stipulated through numbered gold bars supplied by LBMA (London Bullion Market Association) approved suppliers along with suppliers’ quality certificate.

The imported gold will be stored with regulated vault managers. IIBX members include Motilal Oswal Finsec IFSC, Globe Capital IFSC, Anand Rathi International Ventures IFSC, SMC Global IFSC, Stockholding Corp. of India among others.

In the time to come, IIBX plans to create a regional bullion hub facilitating wider participation and thus extending the benefits.